Banking on Thin Ice: When Tech, Crypto, and a Tangled Web Topple Titans

A surprisingly entertaining deep dive into the recent failures of three major U.S. banks and the factors that sent them sliding

The Surprisingly Intriguing Story of Bank Failures

Over the last two months, the 16th, 25th, and 30th largest U.S. banks (at the time) have failed, and the explanations as to why might be surprisingly interesting. In this article, I want to explain how the rise of cryptocurrency, rapid advancements in technology, and the interconnected nature of our world have all played a role in the recent banking crisis. Wish me luck!

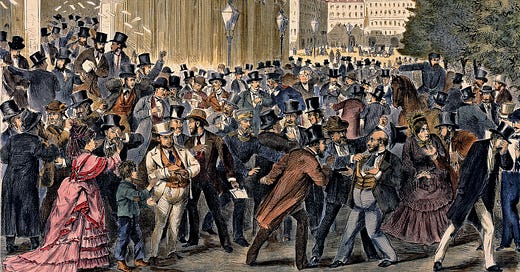

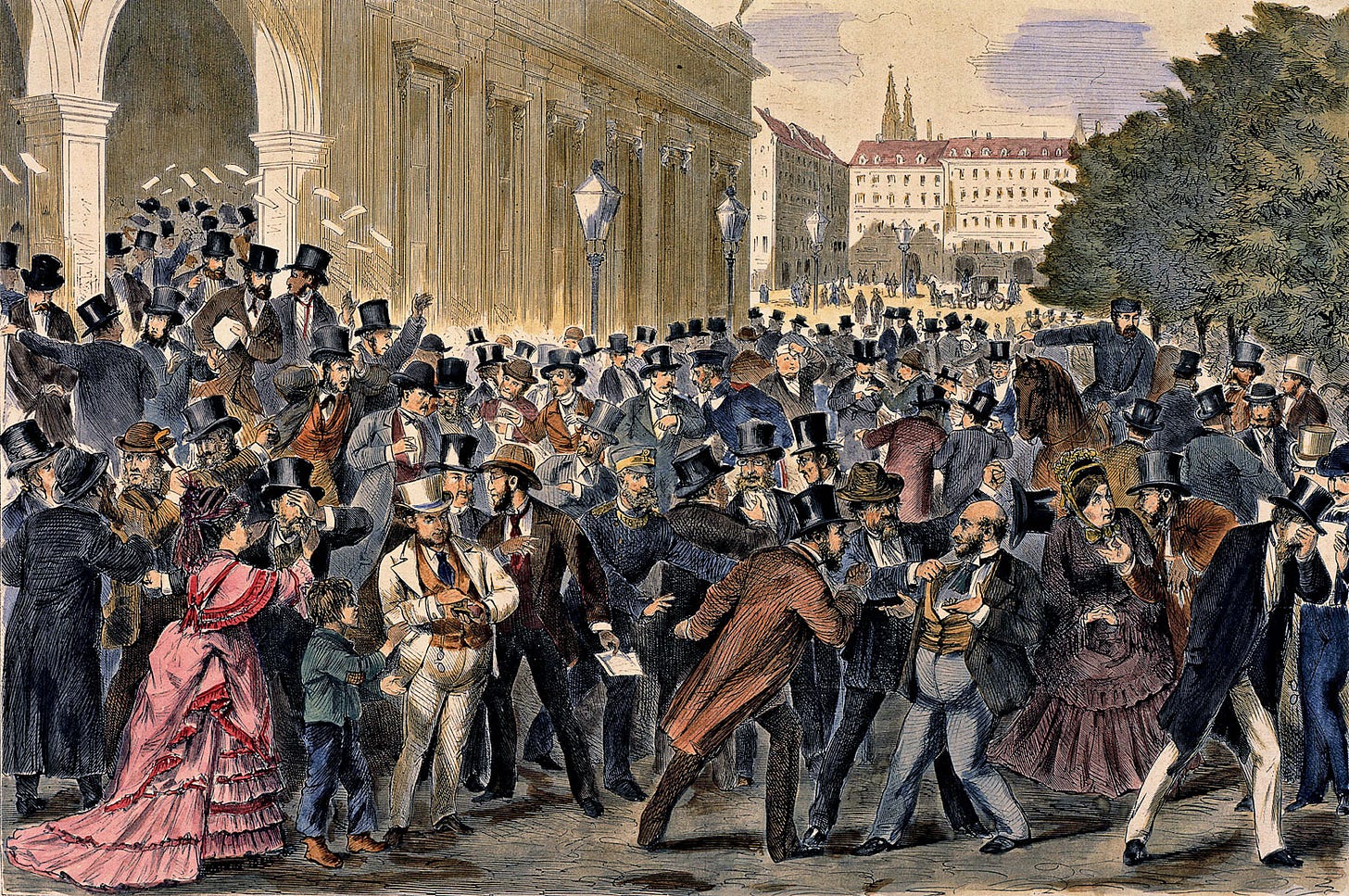

By unknown; uploaded by User:el_bes - Die Presse Edition: Das Imperiale Zeitalter 1871-1914, Public Domain, https://commons.wikimedia.org/w/index.php?curid=9026828

Banks: How Do They Work?

Before we dive into the current banking crisis, let's make sure we're all on the same page about how banks actually work. Banks use a system called fractional reserve banking. What this means is they only need to hold a small portion of their customers' deposits as reserves. They can lend out the rest of the money, creating new loans and expanding the money supply in the economy. This …

Keep reading with a 7-day free trial

Subscribe to Goatfury Writes to keep reading this post and get 7 days of free access to the full post archives.