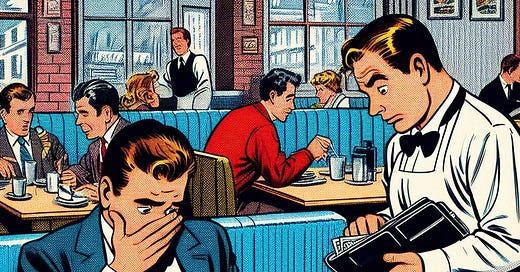

Frank McNamara and Ralph Schneider were having a great lunch meeting at Major's Cabin Grill, a busy diner right next door to the Empire State Building.

The two colleagues exchanged ideas amid a cacophony of clattering plates. Familiar, intoxicating smells from the kitchen, sounds and sights of hungry diners in a bustling city, and great flavors stimulated the conversation.

This was 1950 in New York city—a booming time and place for business. World War II had left the US in a position to do business with the rest of the world and to prosper domestically. While most of Europe and Asia had been decimated by war, much of the US had come out relatively unscathed. Now was a great time for business in the US.

The two Hamilton Credit Corporation executives had a lot of experience with lending credit to businesses and customers, and the universe was theirs to conquer. Nothing could go wrong today!

As the meal wound down and the waiter presented the check, a moment of dread washed over McNamara.…

Keep reading with a 7-day free trial

Subscribe to Goatfury Writes to keep reading this post and get 7 days of free access to the full post archives.